The European Capital Markets Union and its rhetoric on growth and financial stability

After a few years of crisis-born reticence, the European Commission is back in love with the financial sector. Presented as a way of stimulating the dragging economic growth in the EU, the Commission has recently proposed a series of new financial reforms called the Capital Markets Union (CMU). Although promising to set the stage for growth, jobs and investment in small and medium sized enterprises (SMEs), the effectiveness of the reforms proposed by the Commission is broadly questioned. Especially the stimulation of ‘loan securitization’, a complex financial product comparable to those responsible for the financial crisis of 2008 in the United States, is cause for concern.

This research article is based on cooperation between SOMO and The Broker, and evolved out of a research paper by SOMO (September 2015) called: European Capital Markets Union, False promises of growth and risks to financial stability?

This research article is based on cooperation between SOMO and The Broker, and evolved out of a research paper by SOMO (September 2015) called: European Capital Markets Union, False promises of growth and risks to financial stability?

A series of expert opinions debates this article and the CMU:

Caroline Metz: Turning debts into a market: the wonderful promises of securitization

Rodrigo Fernandez: The CMU is post-democracy in action.

Frank Vanaerschot: A new era of financial policy making.

Matthias Thiemann: Capital Markets Union and the mirage of resilience.

Robby Riedel: Capital Markets Union – another European failure?

Megan MacInnes: Financial resilience is defined by sustainability, not deregulation.

Jasper van Dooren: The Capital Markets Union: new limits on a democratic Europe.

The Capital Markets Union is presented by the European Commission as a way of stimulating the continually ailing economic growth in the European Union. The idea behind the CMU is to create an integrated European market for trading in shares, bonds and a number of other financial products, such as so-called ‘loan securitizations’, to make it easier for companies to raise money from capital markets, rather than through bank loans.

By doing so, the initiators of the CMU aim to overcome the problem of persistently high unemployment in many of the EU member states. The integration and deepening of European capital markets through several deregulation measures is supposed to improve access to finance for SMEs, as well as infrastructure projects. The logic behind this is that, since the credit crunch started in 2008, banks are reluctant to lend money to such enterprises or projects – but, to stimulate growth, these companies do require finance. The European Commission reasons that by allowing capital markets to operate as an alternative source of finance, the economy will again be able to grow and create jobs.

The promise of economic growth following the implementation of the CMU is based on the assumption that there are large amounts of money capital desperately seeking profitable investment, while, at the same time, there are businesses that would like to invest and create jobs, but cannot do so because banks are not giving them loans. Therefore, the European Commission’s reasoning is that, if banks are unwilling or incapable of bringing these two sides together, then capital markets should do the job, provided the right conditions are put in place first. More information on the Commission’s logic can be found in their dedicated website on CMU and in the video below.The logic of the CMU according to the European Commission

However, the measures proposed in the CMU are not likely to help Europe towards any of these intended gains. On the contrary, the opposite is more likely. Instead of creating growth, jobs and investment in SMEs, the only growth that is reasonably certain is in the revenue for investment bankers and other capital market actors. Instead of decreasing the risk of a financial crisis, expanding capital market financing would exacerbate financial risks without any corresponding benefits. And, instead of delivering more financial stability to citizens, the Commission’s intention to re-direct household savings exposes citizens, in particular, to financial risks, without any corresponding gains.1

Tackling the wrong problem

One of the Commission’s main assumptions in implementing the CMU strategy is that businesses are currently unable to invest because they lack access to loans from banks. But evidence suggests the Commission’s assumptions are wrong. European SMEs have issues finding enough customers who are able to buy their products, not in finding the right investors to fund their activities. This lack of demand in Europe is connected to stagnating wages and rising inequality on the continent. A recent ECB survey about the issues faced by SMEs shows the figures behind this situation. In their answers to the survey, companies cited ‘finding customers’ as their main concern, while ‘access to finance’ was considered least important (see fold out for figures).

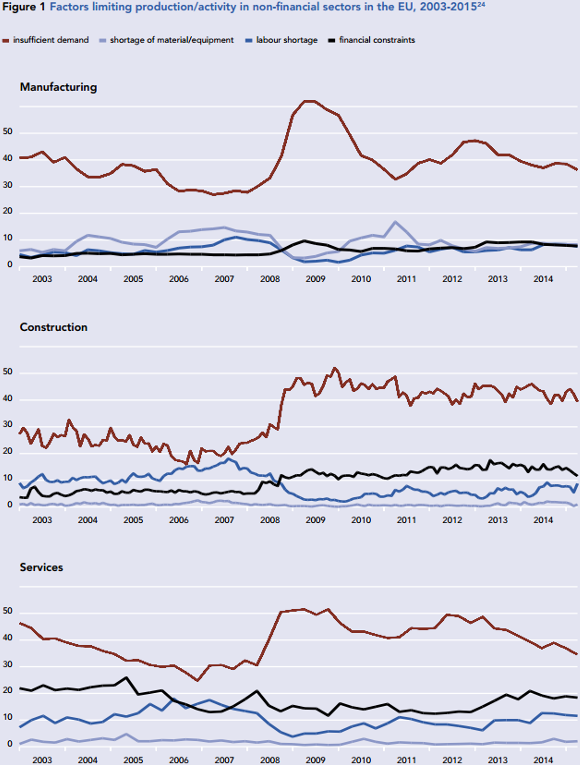

The ECB’s own business surveys consistently show that demand, not financial constraints, are the main factor impeding non-financial businesses. In manufacturing, construction and services the lack of demand is by far the most important factor, and increasingly so since the start of the crisis in 2008.Graphs from the ECB survey

So, if demand problems are not addressed first, deepening capital markets will likely cause a perverse effect. Instead of financing SMEs, which do not consider finance as a main need for improving their business activity, it is likely to create new business for large investment banks, rating agencies and the like, which can use the CMU regulations to generate profit by creating and circulating money in capital market products, sometimes with highly complex deals. Opening up the CMU will ultimately lead to the kind of financial growth that is correlated with weak real investment and low growth in GDP – not the kind of growth that will stir up the European economy.

Academic research2 on the connection between financial structure and economic growth casts further doubt on the Commission’s promises. All economies combine bank and market finance, but they do so in different proportions. There is a lively ongoing debate about whether or not the balance between these proportions matters to economic growth – i.e., for example, whether having a more market-based financial system, in which companies can lend directly from investors or individual households, is preferable to a more bank-based one, or whether financial structure does not matter to growth as long as a country has a well-developed and efficient financial system. The Commission seems to assume that more market-based finance is always better for growth, but this one-size-fits-all view is not generally supported by the literature. In contrast, a broad range of economists suggests that the growth and increasing importance of the financial sector (and capital markets in particular) is negatively related to investment, innovation and growth. Examples include: ‘Stagnation and the financial explosion’ by Harry Magdoff and Paul Sweezy (1987) ‘Why does financial growth crowd out real economic growth?’ by Stephen Cecchetti and Enisse Kharroubi (2013) ‘Finanzsystem und wirtschaftliche Entwicklung: Tendenzen in den USA und in Deutschland aus makroökonomischer Perspektive’ by Till Van Treeck, Eckhard Hein and Petra Dünhaupt (2007) [in German]The connection between financial structure and economic growth

Exacerbating instead of decreasing financial and economic risks

And there is another reason to be suspicious of this type of growth, namely, that it will help the already large financial sector to grow even further, a process called ‘financialization’.

A 2012 report by Bain & Company on trends in the financial system concluded that ‘total financial assets are nearly 10 times the value of the global output of all goods and services’. Further growth of such assets will again increase the risk of ‘asset bubbles’, which have already moved from being relatively isolated events to system-shaking crises causing trillions of dollars in losses.

In creating the US financial crisis in 2007, one instrument played an important role in the US: securitization and other financial products based subprime mortgages (housing for poor people). Among the legislative initiatives that make up the CMU project is a proposal for a regulatory framework for ‘simple, transparent and standardised’ securitization. Since the financial crisis, loan securitization has had a bad reputation, as US subprime mortgages were being securitized in a way that the risks were not clear and the mortgages were sold in an abusive way. Still the goal of this proposal is to stimulate the market for this kind of financial instrument. A Finance Watch report on ‘Boring Finance’ explains more about securitizations.The role of securitization in the 2007 US financial crisis

An important element addressed in the CMU in this respect is the expansion of ‘loan securitization’. Loan securitization is the practice of packaging together a number of similar loans (e.g. mortgages, credit card debt, small business loans) and dividing these packages into two, three or more different slices (so-called ‘tranches’), each carrying a different risk and return, which are then sold on to financial investors. The most senior tranche is less profitable, but also less risky, whereas the junior tranche gives investors a higher return, but is also the first to be affected if the underlying loans are not repaid.

Ideally, creating tranches with different risk-return profiles would also make buying loan securitization attractive to conservative, i.e. risk-averse, investors like pension funds. However, the packaging, slicing and selling of a whole bunch of more or less similar loans makes it difficult to assess how high the risk of default on the underlying loans is. The 2008 financial crisis in the US demonstrated that, instead of decreasing risk, risk was exacerbated because financial products had become so complicated that no one knew what financial risk they held. With a CMU stimulating such constructions, Europeans would be importing similar risks into Europe and increasing the danger of this risk spreading throughout the entire financial sector.

The Commission and other proponents of a CMU claim that SMEs lack access to bank loans and that securitization could help alleviate that squeeze because it would allow banks to put aside less capital buffers and use the money freed for new loans. However, there are serious doubts about whether or not this would indeed result in additional capital for SMEs. The financial risks for the typical SME are too specific to be easily assessed by financial investors using their standard assessment tools. SME risks depend a lot on highly-specific local business contexts and other factors that are not readily understood just by looking at financial statements. This makes securitizing SME loans costly and cumbersome. It is, therefore, unlikely to be a profitable activity for a bank, unless it is publicly subsidized. Moreover, at the moment, European banks tend not to use SME loan securitization to ‘free up’ their balance sheets to lend more. The securities that are created are ‘retained’, rather than ‘placed’, which means that they are not sold to investors in the market. Instead the issuing banks keep them on their balance sheets and use them as collateral to obtain money from the European Central Bank (see page 6). As for the possibility of SMEs accessing capital markets directly through share or bond issuance: this also seems unlikely because this would require considerable preparatory work, such as creating a detailed prospectus to inform potential investors, registration with the relevant authorities and so forth. In most cases, such efforts are not warranted for businesses of this size. Moreover, SMEs, especially family-owned ones, often prefer debt capital to shares because they do not want to share control over the company with other shareholders. The Commission also, erroneously, takes the United States as an example. The US shows higher ratios of capital market financing, which the Commission interprets as an indication of under-developed capital markets in Europe, but these ratios can be interpreted in different ways. They could also indicate that US capital markets have grown too much and are in fact over-developed. Or they could simply reflect different cultures of doing business. Neither of these are inherently better or worse than the other. Interestingly, the staff document does provide a glimpse of an alternative interpretation: ‘Industry structure may provide some explanation for the observed differences between the EU and the US: e.g. there is a higher share of large firms in the US, which tend to rely on public capital markets more than smaller companies’.Loan securitization and SMEs

In addition, past experiences have shown that an increase in securitization contributes to the growth of shadow banking: a less (or un-)regulated niche of the financial system that can cause major economic distress. The financial markets and institutions that make up this sector perform regular banking functions like lending, but do so outside of the traditionally regulated banking sector. But this does not mean that shadow banking is unconnected to the non-shadow part of finance. The so-called ‘special purpose vehicles’ (SPVs) that are created by banks to securitize loans are important players in the shadow banking sector. Unless the risks that emanate from it are taken care of – which has not happened yet – stimulating securitization is also likely to stimulate a build-up of systemic risk in the shadow banking sector.

Shadow banking adds considerably to the complexity, opacity and risk in the financial system as a whole and played an important role in the 2008 financial crisis. Moreover, because a large part of the shadow banking system is legally situated in offshore financial centres (i.e. tax havens/ secrecy jurisdictions), it has been linked to large-scale tax avoidance. Learn more about shadow banking on the SOMO website.About shadow banking

Interestingly, the approach towards loan securitization taken by the Commission in the overall proposal for CMU differs from its own approach in the 2012 ‘Green Paper on Shadow Banking’. Whereas the latter focused on tighter regulation of shadow banking activities in order to reduce the risks associated with them, the emphasis has now shifted back towards facilitating such activities.

And such increased risk is not just limited to the financial sector – it would also potentially create or exacerbate risks to the wider economy. Increasing reliance on capital market financing exposes the general economy to the volatility that characterises these markets. And this volatility would again be further amplified by the creation of a more interconnected financial system. Increasing reliance on these markets increases exposure to the economic cycle, which in times of down swings or crisis can make a bad situation worse. This makes private financial flows, in contrast to public finance capable of providing funding at times of economic shortfall, a relatively unreliable source of funding for what are often long-term projects.

Re-directing household savings into higher-risk investments

The shift towards capital market finance is closely connected to another intended, but not always openly declared, shift. As part of its CMU proposal, the European Commission is also looking for ways to increase the share of household savings that go to capital markets, rather than bank savings. But such redirection would require changing deeply-rooted social patterns. After all, there are entrenched preferences across many households regarding the use of their savings and widespread risk aversion. That is why the Commission brings up improving ‘financial literacy’, in the assumption that consumers who have a slightly better understanding of capital market instruments will be more willing to invest in them.

However, past experiences have shown that the really savvy investors will always understand and play the game a lot better than even the most ‘financially-literate’ consumer. Savings accounts and public pensions may not be particularly lucrative to consumers (currently they hardly deliver any interest rate), but at least they do not expose citizens and their pensions to the risks and uncertainties of financial markets. Moreover, by putting their money into funds that look for a maximum return on investment, citizens would actively contribute to the further financialization of the economy, which could potentially hurt their interests in the long run.

Re-focus on the principal political level

So, the CMU is unlikely to boost GDP growth, help SMEs make the economy grow again or decrease risks to financial crises. On the contrary, it may well boost further growth of the already oversized financial sector, especially in the capital markets. A more exact elaboration of the securitization framework is currently taking place in the European institutions. The framework is presented in a very technical manner, resulting in a discussion on technical details, which will likely pass the European and national parliaments without substantial protest. But, instead of focusing on the technical details, the debate should take place on the more principal political level of the CMU’s implications. As a starting signal for this debate, The Broker will publish a series of expert opinions on the subject within the following weeks.

Caroline Metz: A genuinely democratic debate on the CMU cannot shy away from looking into what securitization really is about: making profit out of people’s debts. Read more. Rodrigo Fernandez: Broadening the debt-led accumulation system means that claims on future income and production are used to solve today’s problems while lessons learnt from past crises are wilfully ignored. Read more. Frank Vanaerschot: The political project to erect a Capital Markets Union (CMU) could be the dawn of a new era of financial (re)deregulation in Europe. Read more. Matthias Thiemann: Drawing on rhetoric of resilient markets and the need for diversity, the European Commission is pushing for a capital markets union to extend market-based finance in the EU. Read more. Robby Riedel: The stepping up of the capital market-based financial system and consequent financial liberalization is neither necessary nor desirable. Read more. Jasper van Dooren: Critiquing the Capital Markets Union plan is invaluable, but only effective as part of a larger critique on the historical, anti-democratic form of European integration. Read more. Megan MacInnes: Does Europe’s reignited love affair with the financial sector come at the price of a divorce from its commitments to climate change, development and human rights? Read more. Debate: experts react on this article

Footnotes

- See the Corporate Watch’s ‘Nuts & Bolts Guide’.

- The argument has not yet been decided, but it is clear that proponents of market finance cannot draw on it for support. See: Beck, Thorsten/Levine, Ross, ‘Industry growth and capital allocation: does having a market- or bank-based system matter?’ and Hein, Eckhard, ‘Finanzstruktur und Wirtschaftswachstum. Theoretische und empirischa Aspekte’.