Phosphorus, a key component of fertilizers, is crucial for the world’s food supplies. But as reserves of phosphate begin to run out, the impacts are likely to be immense – in terms of rising food prices, growing food insecurity and widening inequalities between rich and poor countries.

Reports of the world’s diminishing mineral resources are easy to come by. In the case of oil, for example, there is no shortage of researchers, industry experts and policy makers who are eager to discuss the problems of peak oil, declining reserves, the need for secure supplies and the implications of rising prices for the global economy.

But there is one mineral that has received much less attention. Reserves of phosphate rock, the main source of phosphorus used in fertilizers, are running out. Very few reports have examined the implications of the world’s dwindling supplies, but based on the data that are available, it is clear that alarm bells should be ringing.

Phosphorus is an essential nutrient for all plants and animals. It is also one of the three key components (together with nitrogen and potassium) of fertilizers, and so is crucial for the world’s food supply system. With continued population growth, improving diets and rising global demand for food and biofuels, the need for phosphate fertilizers to improve crop production will only increase.

Over the years, the extravagant use of fertilizers has led to ever-increasing demand for natural phosphorus. As these reserves decline, the impacts will be immense – including falling farm output, higher food prices, growing food insecurity and escalating social and economic challenges for which the world is unprepared. Within a few decades, global economic development could be constrained not just by supplies of oil, but by the availability of phosphorus.

Peak phosphorus

Reserves of phosphate rock are found in several countries, but the largest commercially recoverable reserves are located in just three – China, the United States and Morocco/Western Sahara. At current rates of extraction, the US will deplete its reserves within 30 years, and global reserves will start to run out within 75–100 years. Phosphorus cannot be manufactured from alternative sources, but it can be recovered and reused. Some can be recovered from human, animal and organic waste, but as yet there have been few initiatives to promote recycling.

Phosphate extraction will peak around 2030, after which time demand will exceed supply. Economically recoverable reserves of phosphate rock (those that can be profitably extracted using existing technologies) are currently estimated at 15 billion tonnes, and about 167 million tonnes are extracted per year. According to the US Geological Survey, at the current rate of extraction, which is increasing by 2% per year, phosphate reserves will last about 50 years, but at 3% per year, they will last less than 45 years. In 2008, however, the amount extracted increased by a record 7%, driven mainly by China, where output rose by 10%, and the US and Morocco by 4% over 2007. Even if so-called base reserves (those that are not economically recoverable at present) are exploited, these would be depleted within 75 years if the rate of extraction were to rise to 3% per year. The cost of processing these low-grade base and offshore reserves would also be enormous, raising the cost of producing food, making this commodity the main determinant of global economic development.

Price volatility

The availability of phosphate is reflected in the price of fertilizer, and ultimately in the cost of food. In 2007–8, the price of phosphate fertilizer unexpectedly increased fivefold, due partly to the growing demand for biofuels to replace oil. The use of fertilized crops to produce biofuels such as ethanol pushed fertilizer into a pricing structure determined directly by the soaring price of oil. The result was a surge in food prices, and even conflicts in some developing countries where farmers could no longer afford to buy fertilizers. In response, in April 2008, UN Secretary-General, Ban Ki-moon set up a Task Force on the Global Food Security Crisis. This led to two food security summits – in Rome in June 2008 and in Madrid in January 2009 – to address the soaring price of fertilizer and to devise schemes to lessen the impacts of high food prices on the world’s poor.

Prices might have remained high, had it not been for the economic recession that began to bite in late 2008. As the demand for biofuels fell, so did the need for fertilizers, and so did world prices. The rapidity of the events of 2008 prevented any changes in policies with regard to fertilizer or agriculture, and little was learned from the experience.

What did become apparent, however, was that the fertilizer industry is highly vulnerable because of the link to biofuels, and that many developing countries cannot afford conventional chemical fertilizers. The volatility of the phosphate market also affected the prices of nitrogen and potassium, the two other components of fertilizer, and thus the price of food in general. Clearly, the knock-on societal effects of spiralling fertilizer prices need to be better understood if we are to respond effectively when the next major price shift occurs.

Geopolitical implications

As fertilizer prices rise, the increased inequality of access between rich and poor countries will have major geopolitical impacts. This makes supplies of phosphate one of the most pressing global resource questions, one that requires urgent attention. As public awareness grows in the coming years, the likely response will be a call for action that will have repercussions worldwide, forcing policy makers to acknowledge the gravity of the problem.

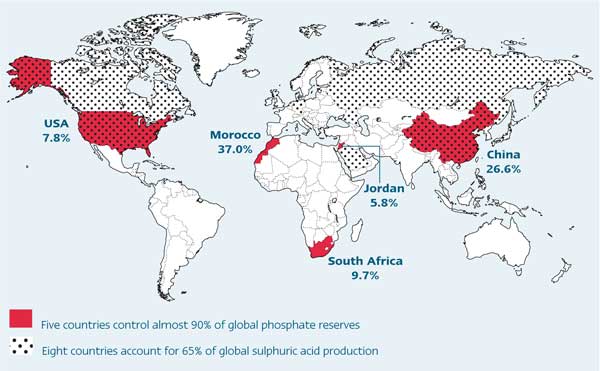

Just five countries together control 90% of the world’s reserves of rock phosphate. China, the largest producer, has already begun to safeguard its supplies by imposing, in mid-2008, a 135% tariff on exports. The US is quickly depleting its own reserves – extraction has now peaked – and is already dependent on imports. Aside from a number of smaller producers, led by South Africa and Jordan, the next largest supplier of phosphate is Morocco.

Morocco’s phosphate reserves are located in the Western Sahara, a territory that is internationally recognized as a sovereign country, but which has been effectively occupied by Morocco since 1975. In 2004, the US signed a bilateral free trade agreement with Morocco that allows the US long-term access to its phosphate. The deal received no media attention. Unsurprisingly, as a permanent member of the UN Security Council, the US has consistently vetoed any resolution requiring Morocco to leave Western Sahara. Australia, in contrast, recently halted imports of Moroccan phosphate in protest against its occupation of Western Sahara, and this move also attracted little attention.

None of the major phosphate producers have so far taken proactive steps to conserve or manage their reserves sustainably. China’s 135% export tariff could result in higher prices, which in turn could encourage more efficient use of fertilizers within the agricultural sector. But its impacts on the demand for phosphate are only likely to become apparent during 2009, once the importing countries have used up their stockpiles. Countries such as India, which are almost entirely dependent on foreign sources of phosphate, will be the first to be most seriously affected by increasing global prices.

A further factor that is likely to become significant in the coming years is the availability of sulphuric acid. On average, it takes nearly 3 tonnes of sulphuric acid and 3.5 tonnes of phosphate rock to produce 1 tonne of phosphoric acid, the basic ingredient of phosphate fertilizers. Sulphuric acid is produced mainly in the developed countries, although China is now also self-sufficient. Sulphuric acid supply and demand directly determine the price of phosphate, so here too there are geopolitical implications. It is for this reason that sulphuric acid producers publish reports and hold conferences to discuss global trends in phosphate production. By controlling the supply and price of sulphuric acid, the developedcountries can in effect control the price of the phosphate they import.

For the smaller phosphate-producing countries that do not have access to cheap sulphuric acid, the situation is similar to that once faced by small oil producers. Their response was to create the Organization of Petroleum Exporting Countries (OPEC), it would not be surprising if the phosphate producers created their own organization to help stabilize markets and phosphate supplies.

The geopolitical impacts of these factors on food security are very much in the hands of the fertilizer and phosphate-producing countries. These are not necessarily the same, since many countries produce nitrogen fertilizers from natural gas. Since fertilizers are made up of nitrogen, phosphorus and potassium, the price of one of these components can directly affect the prices of the other two. As in the case of phosphate, just a few countries control the supplies of potassium (led by Canada), whereas about 60 countries produce natural gas, the price-determining ingredient in the production of nitrogen fertilizers.

These factors are likely to interact in different ways in various parts of the world, making it difficult to predict the impacts on markets as the depletion of phosphate reserves becomes more apparent.

Reducing the risks

Clearly, innovative strategies are urgently needed to ensure greater stability in fertilizer and phosphate markets. More efficient extraction of phosphate at source would help to reduce wastage of this valuable resource. Higher prices could discourage the inefficient use of phosphate products and promote recycling, although price increases should be kept to a minimum in order to avert spiralling food prices.

Crucially, wide-ranging agricultural policy reforms are needed to reduce the demand for phosphate fertilizers. In particular, farmers should be encouraged to use them more efficiently, and to switch to organic fertilizers and composting technologies. In Europe, the EU Common Agricultural Policy, with farm subsidies amounting to €50 billion per year, has created a distorted market that promotes wasteful use of fertilizers, because in effect farmers and consumers do not pay the full market price. Reducing and ultimately eliminating these subsidies would provide more open market competition, and persuade farmers to be more frugal. Consumers must also be convinced that they can play an effective role in controlling food prices through their decisions as to what and how much they eat.

But perhaps the most effective way to minimize the impacts of phosphate shortages would be to promote the recovery and reuse of phosphorus and other nutrients from organic waste and wastewater streams. With policy reforms to promote the development of recycling technologies, the EU could become more or less self-sufficient in phosphorus (see box, ‘Recycling potential in Europe’). Each year the EU uses about 1.34 million tonnes of phosphorus in the form of phosphate fertilizers. Of this, 250,000 tonnes are contained in animal feed supplements and 110,000 tonnes are used in the manufacture of detergents, all of which could be recovered and reused. Arne Haarr, of the European Union of National Associations of Water Suppliers and Waste Water Services, recently calculated how much of the European demand for phosphorus could be met through improved recycling systems.(1) All organic waste contains phosphorus, with animal manure being the most important source. Haarr estimated that the animal waste produced each year in Europe contains around 1.6 million tonnes of phosphorus. And if fully implemented, the EU’s Urban Wastewater Treatment Directive could also have a major impact. In 2005, the EU produced at least 9.4 million tonnes of dry solids from sewage sludge, from which about 300,000 tonnes of phosphorus and other nutrients could have been retrieved. In developing countries, especially in Africa where farmers use limited amounts of chemical fertilizers, recycling could allow them to become almost self-sufficient. For rich countries, a shift to a recycling economy would present major challenges, requiring the retooling of the agricultural infrastructure and the adoption of new farming practices. New incentives such as carbon taxes to combat climate change will also encourage the fertilizer and phosphate mining industries to become more efficient. The production and transportation of fertilizers involves the substantial use of fossil fuels, which could be reduced by shifting to local organic recycling systems. So far there has been little acknowledgement, let alone response, from governments, UN agencies or international NGOs to the world’s dwindling phosphate reserves. The US Geological Survey and the International Fertilizer Industry Association (IFA) publish their own reports, but there is no non-partisan international body responsible for monitoring, compiling statistics or providing policy direction. Yet articles are beginning to appear highlighting the implications of the situation, and the body of knowledge is growing. At an international conference on nutrient recovery from wastewater streams, in Vancouver in May 2009, participants from more than 30 countries met to discuss the status of recycling technology, and to develop ‘new thinking’ for the future. There has also been little response from the private sector. The major phosphate mining companies tend to keep a low public profile, and are not known as leaders in sustainable resource management. Fertilizer companies also are more interested in potential profits than in conserving this finite resource. Above all, efforts must be made to improve public awareness of the problem. Most people acknowledge that mineral resources are scarce, but assume that more will somehow be found. While this could be true for phosphate to some extent, unless action is taken to conserve the stocks that remain, reduce the demand for fertilizers and recycle phosphorus wherever possible, the costs to society are likely be very high – in terms of rising food prices and widening inequalities between rich and poor countries. Bennett, E.M., Carpenter, S.R. and Caraco, N.F. (2001) Human impact on erodable phosphorus and eutrophication: A global perspective. BioScience 51(3): 277–234. Recycling potential in Europe

Footnotes

An unacknowledged problem

References

Cordell, D., Schmid-Neset, D., White, S. and Drangert, J.-O. (2009) Preferred future phosphorus scenarios: A framework for meeting long-term phosphorus needs for global food demand. In: K. Ashley et al. (eds) Proc. International Conference on Nutrient Recovery from Wastewater Streams. International Water Association Publishing, pp.23–43.

Cordell, D., Drangert, J.-O. and White, S. (2009) The story of phosphorus: Global food security and food for thought. Global Environmental Change. 19: 292–305.

Developmnet Policy Review Network (DPRN) Phosphorus depletion: the invisible crisis

Global Phosphorus Research Initiative (GPRI): www.phosphorusfutures.net

Haarr, A. (2005) The Reuse of Phosphorus. Eureau position paper, EU2-04-SL09. European Union of National Associations of Water Suppliers and Waste Water Services.

JDC Phosphate (2008) www.phosphatesustainability.com

Prud’homme, M. and Heffer, P. (2008) World Agriculture and Fertilizer Demand: Global Fertilizer Supply and Trade 2008–2009. Summary Report. International Fertilizer Association.

USGS (2009) Mineral Commodity Summaries. US Geological Survey. View PDF

Vaccari, D.A. (2009) Phosphorus famine: The threat to our food supply. Scientific American, June, pp.54–59. View PDF

Wissa, A.E.Z. (2003) Phosphogypsum Disposal and the Environment. Florida Institute of Phosphate Research. View websiteFootnotes

High Level Meeting on Food Security for All, Madrid, Spain, 26–27 January 2009.www.ransa2009.org/html/en/index.htm