The failure of effective direct taxation is the central explanation for much higher final income inequality. Therefore Cobham and Sumner argue in favour of more fairness in tax systems through metrics.

Debate on the role of inequality in the post-2015 framework has moved rapidly from ‘whether’ to ‘how’: how best to ensure that a range of inequalities are addressed. An important element of this is the inclusive economy agenda, from which two sets of questions emerge: the first on issues of policy (both redistributive and predistributive), and the second (which we’ll address in a later blog) on issues of appropriate measurement.

The UN consultation on inequality within the post-2015 framework has delivered a strong message in its first report, that inequality is bad not just for those at the wrong end of the distribution but for whole societies – resulting in a range of development damage from violent conflict to shorter periods of economic growth. The latter finding, supported by IMF researchers Ostry and Berg (2011), builds on a longer history of research showing that the pursuit of economic growth alone will not only fail to deliver human development but will be self-defeating even on its own terms. Research to which we have contributed supports the case for the importance of tackling inequality to reduce income poverty and to accelerate Millennium Development Goal progress more broadly; as well as making the case for the inherent importance of inequality as a (negative) component of human development.

The role of inequality goes much wider than the economic components of development, but the ‘inclusive economy’ agenda is not as narrow as it can sound. It is worth noting the important work of the Asian Development Bank here, both in stimulating analytical debate around ‘inclusive growth’ (see e.g. important contributions from Stephan Klasen, Ravi Kanbur and Terry McKinley) and in exploring the resulting policy agenda. As Klasen notes, however, ‘inclusive growth’ requires growth: “there is, by implication, no such as an ‘inclusive contraction’.”

‘Inclusive economy’, as a framing, implies a necessarily greater emphasis on sustainability. The most obvious indicator is the distribution of final incomes; but this is the result not only of late stage interventions to redistribute market incomes, but also (and perhaps more importantly) of policies that underpin the distribution of those market incomes. These include, in turn, not only the more immediate such as labour market policies, but also the more distant – but crucial – such as policies that influence access to and the distribution of education, health and nutrition from birth. Questions of sustainability arise in relation both to the stability of any gains made, but also around the important issue of inter-generational redistribution – not least, in relation to the use of finite resources.

Distinctions between stages of distribution are somewhat less clear when we consider their application. Where national statistics allow, for example, it is possible to trace the effect of taxes and transfers on different households, and to see the effect by comparing the market income distribution and the final distribution of income. However, this will include some of both redistribution and predistribution: not only taxation of income and cash transfers to those on low incomes, for example, but also in-kind transfers such as the provision of healthcare and education. The latter often exert the largest redistributive influence in lower-income countries, but are as much an attempt to reduce inequalities facing children now – and hence future income-earning inequalities – as they are aimed at improving the current final distribution.

Meanwhile, the role of labour market and macroeconomic policies can be fundamental in setting the parameters on the distribution of opportunities to earn market income – for example, the importance of labour market changes in Brazil’s inequality reduction is often overlooked, in favour of a narrow focus on conditional cash transfers of which the direct effect has in fact been relatively limited.

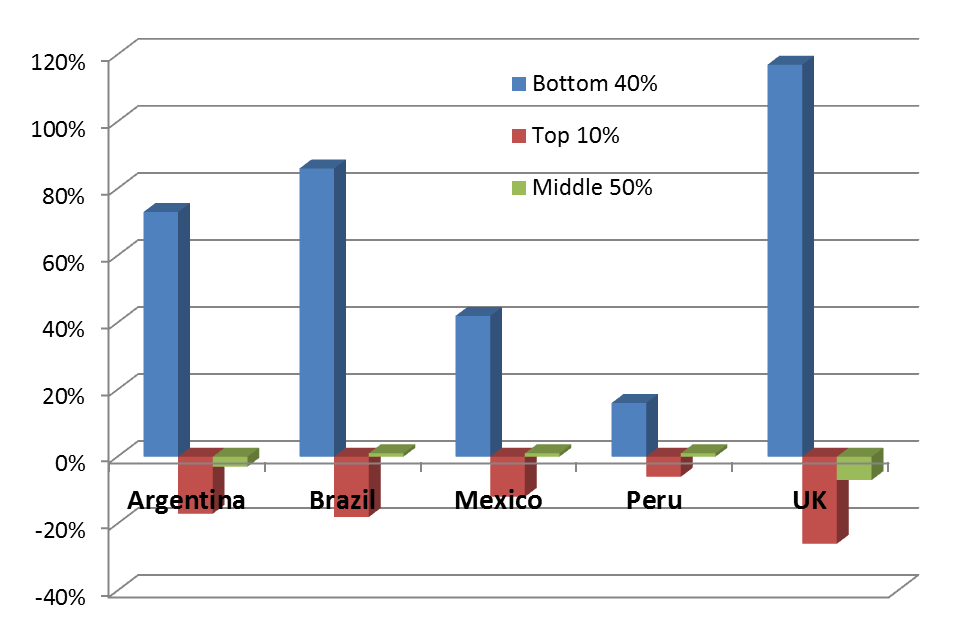

Figure 1, for example, shows the extent of changes between the distribution of original market incomes, and that of final incomes, for five countries where we have data. Aside from the much greater redistribution in the UK, one clear feature is that the ‘middle 50%’ (households in the fifth to ninth deciles) are relatively untouched as a group by redistribution; the clear majority involves a redistribution from the top 10% to the bottom 40%. The data are drawn from our paper proposing the Palma, this ratio of income shares of the top 10% to the bottom 40%, as a powerful policy measure of inequality. (Read also Sumner’s and Cobham’s blog post for the inequality debate: Palma vs Gini measuring Post-2015 inequality.)

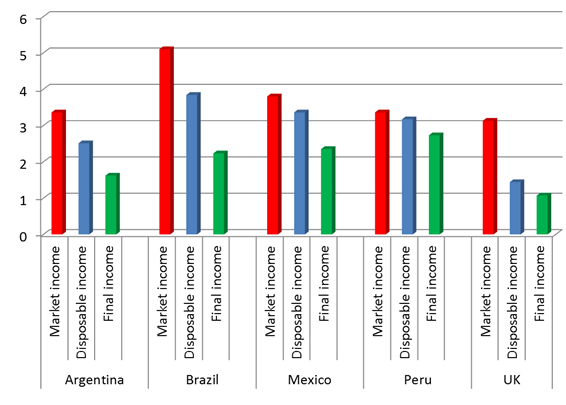

Figure 2 breaks this down further. Here we show the Palma ratio at different stages of the distribution. With the exception of Brazil, the original market income inequality is similar. The UK, however, is much more successful at reducing inequality by final incomes through redistribution. The type of redistribution is key: while most of the work is done in the UK in the taxes and transfers that change market incomes to disposable incomes, the opposite is true in the rest of the sample. Here, more redistribution happens from disposable to final income, meaning it results largely from the provision of in-kind transfers such as health and education provision.

The failure of effective direct taxation is the central explanation for much higher final income inequality. Domestic resistance, not least from the top 10%, is not unexpected; but doesn’t explain why some countries manage better than others. The post-2015 framework could offer useful visibility and accountability to inequality overall, and also to the fairness of tax systems through metrics such as these.

It is worth considering the international aspects also to the problem of effective direct taxation. As the global crisis continues to remind us, economic and financial globalisation has pulled far clear of the ability of national systems of regulation – including taxation. The ability to hide ownership of assets and income streams through secret bank accounts and anonymous companies poses a serious threat in multiple arenas, from terrorism financing to taxation. The related issues of corporate tax avoidance and evasion may be responsible for even greater tax losses. The easier it is for members of the elite to sidestep their social responsibilities with impunity, the less effective will direct taxation be – and the higher is likely to be inequality. This is why the G8 agenda is so important this year; but also why the importance of taxation and illicit financial flows must be reflected in the post-2015 development framework.