The much-debated squeeze of the middle class in Europe is real, but very different from country to country. The squeeze is felt most in the countries most affected by the financial crisis, like Spain, Italy, Portugal and Greece, where austerity measures aimed at curtailing public debt have impacted tremendously on the living standards of the middle class. But, even in some of Europe’s most stable economies, the middle class is struggling, which may be one of the factors in the rise of radical, nationalist parties across the continent.

The middle class in Europe has recently moved to the centre of debates about economic growth, wealth distribution and social mobility – and with good reason. Looking at the trends of the European middle class – measured in terms of income, wealth, occupation and skills – the picture does not look bright. The share of the ‘middle’ in Europe is declining in half of European member states. And, although trends differ between countries, those in the middle are struggling to get better jobs and increase their savings and cannot rely on property values for wealth creation. While past generations of European middle-class families could expect to improve their living standards, the current generation are insecure about a better future.

Trends in social mobility based on income are mirrored in the current assets of the middle class. Vulnerability, which affects a quarter of the middle class in Europe, comes in many forms: shrinking assets as a result of declining incomes and social security cutbacks, precarious labour conditions and rising job losses in traditional middle-class professions. Different coping strategies of European governments, either protecting the middle through redistribution or burdening them to increase state revenue and alleviate debt, have left their mark on Europe’s political landscape.

However, it is too bold to simply say that the whole middle class in Europe is shrinking or under threat. The European middle class is not a single entity or social group. They face different difficulties and have different interests, not only between countries due to different policy approaches, but also within countries. Some parts of the middle are moving upwards and others are moving backwards. Saying that the middle in Europe is shrinking does not tell us a lot if we don’t specify who is moving and in what direction. Having said that, it is increasingly clear that the lower and middle income and skilled groups within Europe’s middle class are struggling to improve their living standards.

Within Europe’s social architecture, there is room for policies to improve the position of the middle. Iceland has shown how a country heavily struck by the financial crisis can retain its middle class through redistributive policies. Poland has introduced ‘inactivity leave’ to counteract collective dismissals that could tip lower middle-class households over the edge into poverty. In Ireland, new mechanisms for civic dialogue have been ignited to strengthen the middle’s political power and alleviate social tension. These initiatives might require significant investment by national governments, but biting the middle-class hand that used to feed these state budgets is not a sustainable solution.

Global trends on the middle

There is also good news about the middle class, but mainly in developing countries. Recent research has proclaimed the rise of a ‘global middle’. Mario Pezzini of the Organisation for Economic Cooperation and Development (OECD) Development Centre anticipates that the global middle will increase from 1.8 billion in 2009 to 3.2 billion by 2020. 1 The Allianz Global Wealth Report 2014 founds that, in terms of wealth, the middle classes have doubled in Latin America, increased threefold in Eastern Europe and grown by an astonishing sevenfold in Asia since 2000. 2 Today, only 30% of the global middle live in North America and Western Europe, a significant decrease from 60% in 2000.

This has sparked a fierce debate in the United States about the state and future of the middle class in a globalized world. The middle has been the subject of debate in the US since the late-1990s, due to concerns about outsourcing and deindustrialization. With the US being far less a welfare state than the EU, the middle class has been portrayed as having gone missing, being endangered, fragile or squeezed and overall struggling for survival. The US government under President Barack Obama has even established a Middle Class Task Force to stop this endangered species disappearing.

But what is exactly happening with the middle? Does it need to be saved? And, if yes, how? Who belongs to this group, and what does it mean to be middle class in Europe in terms of daily life?

Different ways of looking at the middle

Whereas socio-political definitions in the tradition of Karl Marx and Max Weber identify determinants such as education, profession and skill level, or even self-identification, as defining the middle class, most contemporary economic research focuses on income distribution and consumption levels to identify who belongs to the middle. Overall, four main dimensions can be used to understand what has happened to the middle class in Europe: income and consumption, vulnerability to descent into poverty following economic shocks, occupation and skills, and self-assessment. However, looking at the European middle class through these four prisms does not provide a unitary picture.

Why look at income in the first place? As the most straightforward indicator of an individual’s economic power or ‘economic command’ 3 income level allows direct inferences to be drawn about social status in a world driven by capital. Definitions of the middle class based on income are based on either relative income or income in absolute terms. Relative definitions of income use percentiles or median/mean values, which position the middle class within a national or regional context in relation to other income groups. Absolute definitions merge data from developed and emerging economies and define a global threshold and upper level for middle-class membership. While this approach painstakingly demonstrates the grave disparities between the middle in developing and developed countries in terms of living standards, absolute definitions offer little information about the true-life experiences of the middle in their respective country contexts (see more in box 1 at the end of this article).

The declining middle

One of the standard relative definitions situates the middle class between 75% and 125% of the national median income. In Denmark, Norway and Sweden, the share of the population within this specific income parameter accounts for almost half of the population. However, in Mexico, the United Kingdom and the United States, according to this measure, the middle class would not even make up a third of the population. 4

It seems that the higher the average income of the middle class in European countries, the larger it is. European countries with the largest middle class in 2012, namely, Luxembourg, Norway and Denmark, also have the highest average income for middle-class households. The reverse, however, is not as clear: countries with the lowest average income for the middle class can host a small (Romania, Bulgaria) or a large (Hungary, Slovakia) middle class.5

Based on national surveys of household income from the 1960s to 2009, the Luxembourg Income Study (LIS) found that in 12 countries in Europe, including Germany, Poland and Belgium, the share of the middle class has decreased over the last 20 years. Yet these significant drops in the national middle’s share occurred at different times. Across the continent, the middle shrunk by up to 10% in the Western European economic strongholds of Luxembourg, Belgium and Germany. For the declining German middle, ILO affirms the downward slide theory: between 1997 and 2012, 5.5 million middle class people became low wage earners, while only 0.5 million graduated to the ranks of the upper class. 6

The middle shrunk by up to 11% in Eastern Europe’s high-income countries (Poland, the Czech Republic and Slovakia) from 1960 to 2009. 7 In Romania, the share of the middle class amounted to 20% in 2008, dropping to a mere 10% during the financial crisis. 8 Yet there has been no unitary response to the financial crisis. While the middle class declined rapidly in Luxembourg and Slovakia and mildly in Germany, Finland and Romania after the financial crisis in 2007, it stabilized in Belgium and even increased in the Czech Republic and Poland. In the latter two countries, however, the middle class remained far below its first recorded level in the mid-1990s. 9

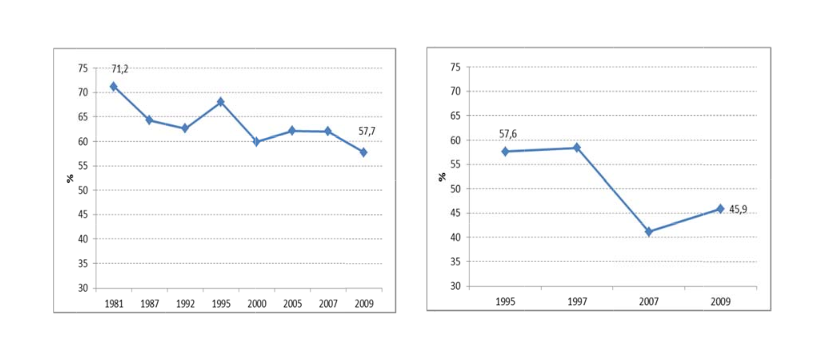

Figure 1: Share of the middle class in terms of income level for Slovakia (left) and the Czech Republic (right (Régis Bigot, Patricia Croutte et al. (2012), The Middle Classes in Europe: Evidence from the LIS Data, LIS Working Paper Series, No.580, p.15)

Can these different dynamics in the aftermath of the financial crisis be explained by the social policies of the respective states? The cases of the Czech Republic (in which the middle strongly increased) and Slovakia (in which the middle sharply declined) are baffling. Both states have relied on a flat income tax for more than 20 years and saw a steady rise in income levels, which spurred economic growth and investment. Strikingly, Slovakia is one of the largest redistributors of wealth in the OECD, with public expenditure amounting to 50% of GDP, making it the frontrunner among a group of countries with a similar level of development. Therefore, the decline in the Slovak middle class can be partly explained by the movement of a large number of its members into the upper class. According to the OECD, public transfers in Slovakia led to a rise in household incomes between 2007 and 2010, an exception in crisis-ridden Europe. However, in the long term, both Slovakia and the Czech Republic have seen a decline in their middle classes. Therefore, such data shows how difficult it is to draw simple conclusions, as many factors simultaneously impact on the status of the middle.

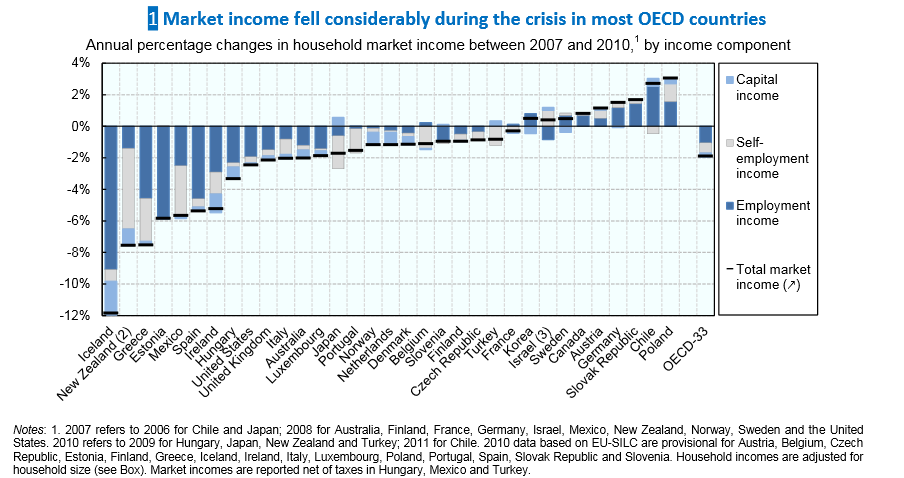

Figure 2: Market income in OECD countries between 2007 and 2010, Source: Michael Forster, Horacio Levy (May 2013), Crisis Squeezes Income and Puts Pressure on Inequality and Poverty, Results from the OECD Income Distribution Database, OECD.

The stable and rising middle

On the other hand, the share of the middle in France, the UK, Italy, Spain and the Netherlands remained stable for the same long-term period (1960 to 2009), and even increased in Denmark, Ireland, Greece and Hungary. 10

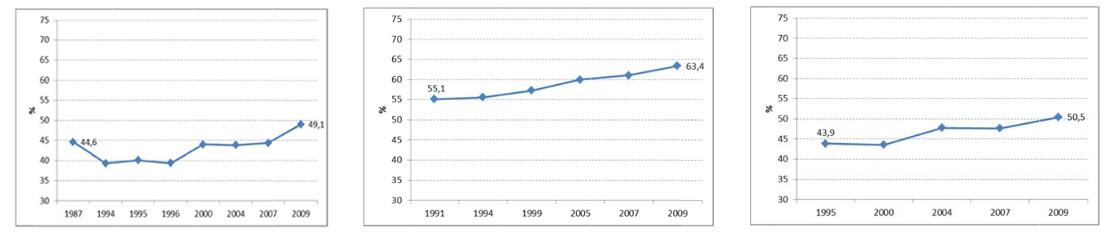

Figure 3. Share of the middle class for Ireland (top left), Greece (lower left), Hungary (lower right)(The Middle Classes in Europe: Evidence from the LIS Data, p.18)

But is this good news? Ireland, Greece and Hungary are three of the European countries most affected by the economic crisis. 11 It can be assumed that the growth of the middle class is a result of the downward social mobility of the formerly rich, although accounts differ on which social group truly shouldered the burden of the crisis in these countries. 12

What makes looking at the size of middle income groups problematic is that a multitude of factors impact on their situation. Declining or rising shares of the middle based on income do not provide an insight into the root causes of these dynamics. And a decline or rise in income for the middle does not necessarily mean that its size has also changed, especially if such changes in income levels affect all strata of society. In the case of a collapsing economy, such as in Greece, the median income of the whole country has dropped rapidly, but without affecting the share of the middle in the country. A large middle class purely based on income, hence, is not a sufficient indicator of social progress or prosperity, as the Bertelsman Foundation’s 2014 Social Inclusion Monitor and reports of the European Commission on Europe’s social and employment situation demonstrate. 13

Being in the middle, but asset-poor

Thus, income alone cannot accurately describe who belongs to the middle, or what that means in terms of daily life. While middle-class consumers are a new phenomenon in emerging economies, the middle classes in the developed world have seen their assets and savings shrink. This is partly due to decreasing incomes, but also to social expenditure cutbacks, which force the middle class to increasingly invest in private pensions and health care.

Consumption, in contrast to income, includes all of a household’s resources and long-term assets, such as savings and insurance. 14 The economic security associated with the middle class requires households to own real and financial assets that go beyond necessity, such as houses and cars, insurance coverage and increased spending on health and education.15 Markets are swiftly responding to changing societal structures and resulting consumption patterns. In an interview with The New York Times, a PricewaterhouseCoopers representative argued that US businesses would not ‘want to be stuck in the middle’ amidst rising demand for high-end and dumping price products by US consumers 16 Traditional middle-class retailers have seen investors’ shares declining, and the customer base of mid-tier restaurant chains has likewise decreased.

Assets such as savings and insurance can also change income-based class status, and not just for the better. Middle-class households whose asset holdings would not provide a cushion in case of sudden income loss are called ‘asset-poor’. 17 If faced with such a sudden income loss, about half of middle-class Germans and Americans would not have enough financial assets to sustain their standard of living at the poverty line for at least three months. This measure would shrink the national middle class in these countries to 31% or less. 18

In 2014,15% of the European population experienced financial distress (defined as the need to rely on savings or incur debt) – an historically high level. 19 As both savings and the eligibility to take on loans can be attributed to median incomes, this exemplifies the squeeze on the European middle class. The 2014 Allianz Global Wealth Report found that savings have continuously decreased in Western Europe, with the level of savings cut in half since a 2005 pre- crisis high. Savings, however, remain the preferred financial asset for Western Europeans, which, together with insurance policies and pensions, amount to 70% of their investment portfolio. 20 According to this report, Eurozone households not only decreased their saving rate, but at the same time increased their liabilities.

The middle class has become a new group of debtors, who, most often due to unexpected unemployment, cannot pay for food or their children’s education, as Eurofound observed in Portugal and Ireland. 21 Strikingly, it seems to be the aspiration to a traditional middle-class lifestyle, with house and car ownership as well as expensive consumer technology, that leads most middle-class households into over-indebtedness. 22

Not poor, but barely middle

Vulnerability to poverty calls into question the meaning of the label ‘middle class’ by looking at actual living standards. Indicators of vulnerability are mostly based on consumption and assets. The quarter of the European population who belong to the vulnerable middle cannot afford goods beyond necessity, hold significant loans and depend on income from social transfers.

Based on the assumption that being middle class means economic security, the vulnerability approach distinguishes between ‘securely middle class’ and ‘not poor anymore, yet not quite middle’. 23 World Bank economists Louis F. Lopez-Calva and Eduardo Ortiz-Juarez establish the absolute lower threshold of the middle class at 10% probability of falling into poverty, avoiding what they call a common flaw in contemporary research, namely, lumping the poor into the middle class category. 24 The president of the Center for Global Development, Nancy Birdsall, projects that in Latin America alone, 250 million people will fall into this group, which she calls ‘strugglers’, by 2030. 25

The vulnerability approach demonstrates that the celebrated growth of the middle in developing countries is simplistic and premature, while also illustrating the dire situation in Europe. While Birdsall’s number of strugglers might entail upward as well as downward social mobility, it means de facto economic insecurity. In Europe, the strugglers are referred to as affected by ‘material deprivation’. 26 In the European Union, 25.4% of the population are at risk of sliding into poverty, including parts of the middle class, a number that has risen by 2% since 2009, according to the Bertelsmann Foundation’s 2014 Social Inclusion Monitor.27

What further distinguishes the upper middle class from its lower counterpart in Europe and is linked to the strugglers in emerging economies are their sources of income. For the lower middle class in 12 of the EU-28 countries, including Sweden, Norway, Poland, Estonia and Hungary, income from social transfers (such as unemployment benefits, child and family benefits, and old-age benefits) make up around half of their income. In 5 of those 12 countries, social transfers contribute more than 50%. Hungary, which also hosts one of the biggest middle classes on the continent, holds the record high with 63% of lower middle-class income being obtained from social transfers. 28 In the US, according to the conservative Wall Street Journal, cash transfers to the middle class have seen a 25.9% increase since pre-recession 2007, while middle income tax payments fell by 24.4%. 29

The recession’s effect on the middle class

The economic crisis left its mark on the middle around the world. Homeownership (often tied to mortgages), as a traditional middle-class characteristic, was devastated by the bursting of the housing bubble. Austerity measures in the form of social and labour market policies aimed at the middle are another factor. As a result of these factors, the living standards of the middle deteriorated in the countries most affected by the financial crisis, although not as drastically as for lower income groups.

For the United States, the impact of the financial crisis on the middle income group is best tracked through median wealth (i.e., assets with debt deducted). While the wealth of the upper income tier remained unaffected, median wealth declined by almost a third. 30 The reliance of the middle classes on home equity, which makes up 40% of their assets, is one of the reasons why this group was hardest hit when the housing bubble burst. Incomes for the US middle class remained stagnant even before the crisis, with the median per capita income of US$18,700 in 2010 unchanged since 2000. 31 Following the ‘great recession’, as the US media frames the financial crisis, 85% of middle-class Americans said in 2012 that their living standards had declined compared to ten years ago. 32

Similarly, the countries in Europe that were hit hardest by the financial crisis saw not only increasing unemployment in the middle income sector, but also the exacerbation of the situation of the middle class through significant cuts in the social protection system and the decreased quality of public services. 33 And, if they owned property, the value of their property declined significantly.

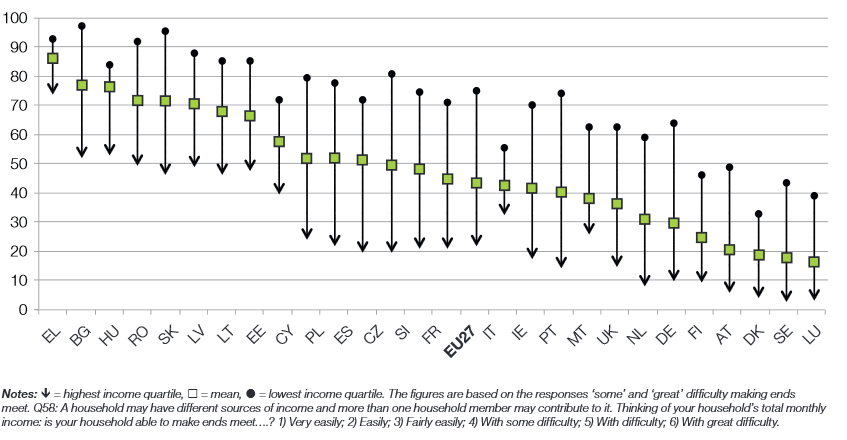

How drastically life experiences changed is portrayed in the middle’s situation with regards to the most basic needs. Members of the Greek middle are no longer able to meet their medical needs, 34 a trend that is mirrored across Europe. Costs, the most limiting factor in accessing health care, have increased sharply since the financial crisis. 35 In the EU-28, about 45% of the middle income group report difficulty making ends meet, with national differences of as much as 86% in Greece and Estonia, compared to a low of 17% in Luxembourg (see figure 4). 36

Difficulty making ends meet, by income quartile (%),Eurofound ‘3rd European Quality of Life Survey’ (2012)

What it means to be middle today

Another aspect of the middle’s situation is demonstrated by the rate of severe housing deprivation. 37 In 2013, an average of 6.5% of the European population were middle class and experienced severe housing deprivation. 38 In Latvia, Romania and Hungary, the number of middle-class people affected by severe housing deprivation even exceeded 25% of the total population. For Western Europe, the percentage ranged from 1.4% for Germany, to 3.1% for the UK and 12.5% for Italy. The phenomenon of middle-class Italians moving to trailer parks, the streets or shelters for the homeless is a vivid illustration of these statistics.39

Precarious working conditions such as part-time work and short-term or temporary contracts have added to the general employment and pay cuts that have affected middle income jobs, for instance, in the public sector. 40 In the most crisis-ridden countries, stories like that of a Portuguese government agency secretary now working as a cleaner in Switzerland are no longer the exception. 41

With regards to tax policy reform under Europe’s austerity packages, the ILO found that the post-crisis tax burden has increased for low and middle income families in, for instance, Spain, Portugal and Greece. 42 Increased property taxes, for example, have hurt middle-class homeowners and small businesses in Ireland and Italy.

These measures not only gnaw at the very foundation of the European Social Model, but fuel a vicious cycle, as the shrinking middle class is the main financier of social and public services. While policy reforms burdening the middle might lead to a temporary reduction in state expenditure, they will in the long-term shrink revenue if the middle continues to slide downward, a fact that is recognized in recent reports by leading international institutions such as ILO and independent organizations like the Luxembourg Income Study.

Iceland is a striking counter example. Despite the fact that the financial crisis diminished national wealth equivalent to seven times Iceland’s GDP, 43 the Icelandic government responded by letting international banks go bankrupt and protecting the purchasing power of middle and lower income groups. While price inflation also affected the middle, the government drew on high-income households for their redistribution policies, wrote down household debt, and provided interest subsidies to households for loans – strategies that were lauded by leading progressive economists like Joseph Stiglitz and Paul Krugman. 44

So policies do matter in terms of ‘saving’ the middle class. This assumes voting power in favour of more security for the middle, especially in European countries with a large middle class. While there is no clear-cut evidence that relates the squeeze on the middle to voting behaviour, some dynamics can be identified. Radical parties have been on the rise in Europe, with a significant increase in their representation in the European Parliament since the 2014 elections, but also in national political debates. Strikingly, radical right-wing parties saw their strongest growth in countries with a stable middle, indicating a fear of change and insecurity among the middle. On the other hand, the most crisis-affected countries with a suffering middle class tend towards left-wing parties and movements calling for an expanded social safety net, basic income and even a complete overhaul of the current financial system (see more in box 2 at the end of this article).

Identifying the middle class through occupation and self-assessment

There is another way to look at the middle that can help explain the political shift in Europe. Lifestyles and occupations are increasingly believed to be threatened by economic globalization and technological changes. Living with increased insecurity creates fear of further change. Looking at occupations, the middle class appear to have been at the eye of the storm of transitioning labour market dynamics, with shrinking occupation opportunities (this will be examined further in this dossier in the articles of Evert-jan Quak and Jo Michell). Empirically, occupation is the most stable indicator of middle-class membership, while classifications based on income, self-assessment and vulnerability can differ by up to 50% over a time span of only two years. 45 Financial Times journalist Simon Kuper, on the other hand, has convincingly argued that loss of professional identity (either through redundancy or technological change) has left the middle class in an identity crisis. 46

But what about the quality of contemporary middle-class jobs? In its examination of British households, the Social Market Foundation founds that the jobs of the middle income group are often low-wage positions, resembling those of the low income group. Fifty per cent of middle-class households in Britain are in the four lowest skills occupations, including elementary occupations, machine operation, service occupations, and the care and leisure sector. 47 Low-wage industries, for example in the UK and US, also saw the highest growth rate during the recovery, with the prospect of more than a quarter of US jobs in these sectors by 2020. 48 The New Left Project, a left-wing US magazine, sees the precariat not as a separate class, 49 but a phenomenon that transcends social strata and reaches deep into the heart of the middle class. 50

Self-assessment and self-positioning often contrast with purely economic definitions of middle-class status. The lower middle classes, who experience persistent economic insecurity, do not identify with the affluent middle classes. 51 In Europe, concerns about economic security also seem to influence self-categorization in terms of class. The French middle class feel like they have consistently grown poorer since 2001, as a Credoc Survey on living conditions and aspirations in 2011 showed. 52 LIS data, however, proves that middle-class household incomes have slightly increased, but that upper-class incomes have increased at a greater rate. Thus, it seems that, overall, income inequality prevailed over personal gain in determining the French middle’s self-perception. 53 In the UK, the situation is similar. The 2013 British Social Attitudes Survey found that six out of ten people identify as working class and only one third as middle class. Although the size of the middle class defined by occupation rose from 47% to 59%, people’s perceptions of their class status were the same as in 1983. 54

The real effect that this self-perception has on consumption patterns and, thus, middle-class purchasing power cannot be ignored by policy-makers. Among American households, 62% said that they had reduced their household spending 55, which demonstrates an important fact – that perceptions might trump economic reality and create their own economic impact. (See why the middle class in the US feel squeezed at CNN Money ‘This is why the middle class feels squeezed’.)

A class beyond repair?

Although the term ‘class’ suggests common features uniting middle classes worldwide, what it means to be middle class varies greatly, not only between developed and emerging economies, but also within these broad categories. The middle class in Europe is not a single entity or social group. Its members face different difficulties and have different interests.

What this article has shown is that the middle classes in Europe are struggling. They may not live in poverty, but they are asset-poor, vulnerable to economic and personal shocks, have few opportunities for upward job mobility, and their wage levels are not improving significantly. Social protection and welfare expenditure are an important part of their income, especially for those in lower middle class, and welfare cuts and social spending have hit income levels. Furthermore, ongoing economic globalization and automation will increase the insecure position of the struggling middle in the future.

Discussion of the ‘middle’ in this dossier will focus on their income, occupation and asset levels by referring to economic globalization (see the article ‘Making globalization work for the European middle class‘ by Evert-jan Quak), automation (see the article ‘Better skills will not save middle-class jobs from automation‘ by Jo Michell), and social security and social protection (see the article ‘A divided middle‘ by Ursula Dallinger). The definition of the middle as the group that has to work for a comfortable living standard, which should be experienced as quite stable and not threatened by small shocks and changes, makes it different from the poor and upper income groups in European society. Looking at Europe’s social architecture, there is plenty of room for policy-making on redistribution measures, taxation, property markets, labour markets, and education that could ease, stabilize, and even improve the position of the European middle.

Box 1. How are the middle classes in developing and developed countries related?

By merging data from developed and emerging economies, absolute definitions of the middle class attempt to define a maximum and minimum income level on a global scale that takes national differences into account. Absolute definitions, thus, allow a comparison between the size and status of the middle classes across countries. Based on purchasing power parity (PPP), economists Branko Milanovic and Shlomo Yitzhaki propose a per capita daily income of US$10–50 to define the global middle class. But the worlds that lie between these numbers are vast, even within a single country.

While 369 million people in developing G-20 economies fall into this middle-class income range, it would translate to a monthly income of €241–1,200. In the EU-28, the average disposable income, i.e., after tax and cash transfers, which Milanovic and Yitzhaki do not seem to factor in, already amounts to €1,283 a month. Someone earning Milanovic and Yitzhaki’s proposed lower threshold of €300 in Europe clearly cannot be considered middle class. More conservative measures even apply a global threshold of US$2–10 per capita daily income to define the middle class.

Above all, this demonstrates that the global middle class might be too diverse to be clustered in absolute terms of income distribution. In July 2014, the Financial Times reported that 2.8 billion people in the developing world subsist on an income just above the poverty line of US$ 2–10 per day, of which the lower range of US$2–4 per day is growing faster than any other income range. These cut-offs defining middle-class income are, of course, arbitrary and, given its associated meaning of economic security, no one living just above the poverty line can be reasonable characterized as middle class.

The life experiences of the global middle are similarly diverse, and seem to be developing in adverse directions, especially if the middle in Europe’s most crisis affected states is compared to that in emerging economies. In Greece, where 28% of the middle class live at risk of poverty, it has become commonplace for them to visit food banks and soup kitchens. Nigeria, Africa’s largest economy, hosts 4.1 million middle-class households, corresponding to 11% of the country’s population. Yet power-outages are as much part of the lives of the Nigerian middle as refrigerators, freezers, stoves and other domestic appliances.

Focusing on one specific indicator, Uri Dadush and Shimelse Ali of the Carnegie Foundation take the number of private cars in circulation as an indicator of the size of the middle class in developing countries. A 2014 Standard Chartered Consumer Aspirations Study of emerging affluent and affluent consumers found that, by 2019, the net change in spending on new cars and motorcycles among Indonesia’s middle class will increase by 10%. The Boston Consulting Group disaggregates these numbers, showing that while 52% of the country’s affluent population owned a car in 2013, this is still a luxury very few middle-income Indonesians can afford. In Ghana, car ownership rose by 81% between 2008–2013, whereas in China 2,500 cars were sold hourly in 2013. By comparison, in the European Union, 75.7% of households owned a car in 2013, according to the European Central Bank.

Box 2. Voting power of the middle

Protests against austerity measures in the aftermath of the financial crisis also came from the very centre of traditional middle-class professionals: doctors, nurses, teachers, the self-employed and even members of the police force. Especially radical political parties have tried to take advantage of this mounting resentment against status quo politics. While established parties on the left, right and centre of the spectrum have struggled to maintain their voter bases due to their alleged ‘compliance with the system’, have the squeezed middle of the countries most affected by the financial crisis turned elsewhere to seek representation?

In the European Parliamentary elections, right-wing parties in fact gained the best electoral outcome in countries little to moderately affected by the crisis, such as Austria, Denmark, France, the Netherlands and Sweden. 56 Drawing on the LIS data, the decline in the middle class in these countries cannot explain this voting pattern: the middle class remained quite stable in four of these five countries, with Sweden as the exception.57 The rise of radical parties in these countries might instead be caused by the middle classes’ fear of global forces like migration, trade liberalization, open borders with the EU, etc., which could potentially increase their vulnerability and flexibility on the labour market, and by lower class voters.

The right-wing British UK Independence Party is a pertinent example. UKIP’s anti-EU populism resonated with both former Labour and Tory voters. Yet their base, the ‘left behind voters’, as the Guardian calls them, are working class members who feel that British politics has been dominated by ’the crucial and decisive battle […] fought between middle-class graduate candidates seeking middle-class graduate votes’. While, overall, political identification has also declined in the middle class, the 2012 British Social Attitudes Survey found that the middle is more likely to support Labour than the Conservatives (38%), a trend which reversed from the middle’s strong favouring of the Conservatives in 1984 (52%). 58

The example of the UK seems to suggest that the middle in EU member states less affected by the financial crisis continued to vote for traditional parties. Denmark, as a country with a flourishing middle class, however, saw almost a third of the votes in its parliamentary elections going to the anti-immigration People’s Party. Hence, the social decline of the middle cannot explain the rise of radical parties alone. 59

The story in those member states whose economies were crippled by the financial crisis is different. In Greece, Syriza is now the governing party, since the recent elections. Syriza proclaimed a proletarization of sections of the middle class as a repercussion of the financial crisis, the need for a reignited discourse on class and the need for a novel policy approach, rather than mere redistribution, to benefit the diverse groups of people making up the Greek middle class.

And Syriza’s rise to power is only one part of the bigger story. The recent rise of Podemos, a left-wing Spanish party that achieved a similar majority to the Socialist Party of some 7% over the governing Popular Party in an El Pais poll in early November 2014, appeals to a struggling middle by proposing universal basic income and more parliamentary control over the European Central Bank.

Eurosceptic parties, on both the left and right, seem to have benefited from a discouraged middle class. Although the rise of radical right- and left-wing parties cannot be fully explained by the decline of the middle, there are strong indicators of a link between the squeezed middle in the countries most affected by the financial crisis and radical left-wing parties.

Footnotes

- Pezzini, M (2012) An emerging middle class. OECD Observer, OECD Development Center,

- Brandmeir, K; Grimm, M; Heise, M; Holzhausen, A (2014) Allianz global wealth report 2014. Public Policy and Economic Research Department, Allianz Group

- Steenekamp, B et al. (2014) The middle class in contemporary South Africa: comparing rival approaches. Stellenbosch Economic Working Papers: 11/14, Stellenbosch University

- LIS database, 2011, as cited in Atkinson, AB; Bandolini, A (2011) On the identification of the middle class. Working Paper 2011–217, Society for the Study of Economic Inequality ECINEQ

- Bigot, R; Croutte, P et al. (2012) The middle classes in Europe: evidence from the LIS data. LIS Working Paper Series, No. 580

- Vaughan-Whitehead, D (2015) Introduction: Is Europe losing its soul? The European social model in times of crisis. ILO

- Bigot, R; Croutte, P et al. (2012) The middle classes in Europe: Evidence from the LIS data. LIS Working Paper Series, No. 580 Classification of these countries as ‘high-income’ is based on: World Bank (2014) Country and lending groups, 2015 fiscal year.

- Arbutina, Z; Seiler, B; Schwartz, R (2013) Maechtige Oligarchen, arme Mittelschicht. Gesellschaft, Deutsche Welle

- In 2007, the financial crisis expanded, leading to worldwide liquidity shortages and slowdowns in interbank lending (European Central Bank, Eurosystem (nd) Timeline of financial crisis: Key dates of the financial crisis (since December 2005), [online]. Available at: https://www.ecb.europa.eu/ecb/html/crisis.en.html (accessed 24 March 2015)

- Ibid.

- Fanjul, G (2014) Children of the recession. The impact of the economic crisis on child well-being in rich countries. Innocenti Report Card 12, Office of Research, UNICEF

- Milanovic, B (2012) Global income inequality by the numbers: in history and now. Policy Research Working Paper 6259, The World Bank Development Research Group, Poverty and Inequality Team, The World Bank

- Schraad-Tischler, D; Kroll, C (2014) Social justice in the EU. A cross-national comparison. Social Inclusion Monitor Europe (SIM), Index Report, Bertelsmann Foundation; European Commission (2014) EU employment and social situation. Social Europe Quarterly Review, Publications Office of the European Union

- Sumner, S (2011) ‘Focus on consumption, rather than income inequalities’. The Economist. Chen and Ravallion maintain that consumption is a more accurate measure for defining the middle class, as it is likely to be reported more diligently in surveys. Moreover, consumption reflects a household’s welfare better than its income, as the latter is often measured pre-tax and does not include non-cash benefits such as social welfare or other subsidies – thus not indicating the true resources available for a household’s spending (Chen, S; Ravallion, M (2008) The developing world is poorer than we thought, but no less successful in the fight against poverty. Policy Research Working Paper 4703, The World Bank).

- Ibid.

- Schwartz, N.D. (2014) ‘The middle class is steadily eroding. Just ask the business world’, 2 February 2014, The New York Times

- Atkinson and Brandolini (2011) establish a direct connection between asset-poverty and income-poverty, concluding that ‘we may want to exclude all asset-poor individuals from the middle class, although their incomes are all above the poverty line’ (Atkinson, A.B.; Bandolini, A (2011) On the identification of the middle class. Working Paper 2011–217, Society for the Study of Economic Inequality ECINEQ, p. 15).

- Atkinson, A.B.; Bandolini, A (2011), ibid., p.16

- European Commission (2014) EU employment and social situation. Social Europe Quarterly Review, Publications Office of the European Union

- Brandmeir, K; Grimm, M; Heise, M; Holzhausen, A (2014) Allianz global wealth report 2014. Public Policy and Economic Research Department, Allianz Group, p. 25

- Dubois, H (2012) Household debt advisory services in the European Union. Eurofound, p. 39

- Ibid., p. 7

- Especially in emerging economies that are volatile to the crises of external markets, this distinction is crucial to the question of whether we can actually speak of middle classes in these contexts (with a delay, the effects of the financial crisis have spilled over, with three quarters of the 4 million jobs lost globally occurring in developing markets in 2012 (Nick Mead (2013) ‘Developing world’s middle class is growing – but so is its ‘near poor’.’ Data Blog, The Guardian).

- Lopez-Calva, L.F.; Ortiz-Juarez, E (2011) A vulnerability approach to the definition of the middle class. Policy Research Working Paper 5902, The World Bank

- Birdsall, N; Lustig, N; Meyer, C.J. (2013) The strugglers: the new poor in Latin America?, Center for Global Development Working Paper, No 337

- The European Commission’s Eurostat Glossary defines ‘material deprivation’ as the enforced inability to pay unexpected expenses, afford a one-week annual holiday away from home, a meal involving meat, chicken or fish every second day, the adequate heating of a dwelling, durable goods like a washing machine, colour television, telephone or car, and being confronted with payment arrears (mortgage or rent, utility bills, hire purchase instalments or other loan payments).

- Schraad-Tischler, D; Kroll, C (2014) Social justice in the EU – a cross-national comparison. Social Inclusion Monitor Europe (SIM), Index Report

- Upper middle class income in the same countries, on the other hand, is on an average of 72% earned by work. Bigot, R; Croutte, P et al. (2012) The middle classes in Europe: evidence from the LIS data. LIS Working Paper Series, No. 580

- The Wall Street Journal (2014) More redistribution, less income. Review and Outlook.

- Taylor, P (2012) The lost decade of the middle class. Fewer, poorer, gloomier. Pew Research Center, Social and Demographic Trends

- The conservative Wall Street Journal took an unexpected populist stance when it published a calculator based on annual income, which allowed readers to place themselves on the 1 to 99% scale of the income distribution scale (Phil Izzo (2011). ‘What percent are you?’, 19 October 2011, The Wall Street Journal).

- See the PewResearch report, (Taylor 2012, op cit.). Guillaume Osier (2014) argues that this perception of decline by the middle might also be caused by perceived income inequality through rising incomes of top earners.

- An ILO report on the European Union’s social system after the financial crisis founds that increasing inequalities and growing poverty have extended to the middle class (Vaughan-Whitehead, D (2015) Introduction: Is Europe Losing Its Soul? The European Social Model in Times of Crisis, ILO).

- Ibid.

- Anderson, R; Dubois, H; Leoncikas, T; Sándor, E (2012) Quality of life in Europe: impacts of the crisis. 3rd Quality of Life Survey. Eurofound

- Ibid., p.39, Figure 13

- Eurostat defines an individual experiencing housing deprivation as ‘someone who does not have access during the reference period to accommodation which meets commonly agreed criteria for human habitation [such as a structurally stable dwelling; free from serious disrepair, with heating; suitable toilet, bath/shower for exclusive use with hot and cold water, effective drainage and sewage system, among others] which he/she can occupy.’ Middle class is defined here as the third and fourth quintile of the income distribution scale. (Eurostat (2004) The production of data on homelessness and housing deprivation in the European Union: survey and proposals. Theme 3 on Population and Social Conditions, European Commission. p. 6)

- Eurostat (2014) Severe Housing Deprivation Rate by Income Quintile, [updated 15 December 2014], EU Statistics on Income and Living Conditions (SILC), European Commission.

- Vaughan-Whitehead, D (2015) Introduction: Is Europe losing Its soul? The European social model in times of crisis. ILO

- González, P; Figueiredo, A (2014) The European social model in times of economic crisis and austerity policies. Portugal. ILO Working Group Presentation

- ILO Newsroom (2012) From public sector worker in Portugal to cleaner in Switzerland [20 September 2012], Feature Report European Labour Migration, ILO. As another case demonstrating the fragility of employment which now extends to the middle class, Greece shortened its notification periods for dismissal of employees in white collar professions with over 20 years of tenure from 20 to 4 months (González and Figueiredo 2014, ibid.)

- Measures specifically hurting the Greek middle included the reduction of income tax rate bands from eight to three; the elimination of selective tax credits; tax allowances for children; the tax-free personal income threshold for the self-employed and professionals, among others (Vaughan-Whitehead, D (2015) Introduction: Is Europe losing Its soul? The European social model in times of crisis. ILO)

- Gylfason, T (2010) ‘Eleven lessons from Iceland’, 13 February 2010, Vox, Centre for Economic Policy Research

- Ólafsson, S (2012) The Icelandic way out of the crisis. Welfarism, redistribution and austerity. Working Paper No 1, Social Research Centre, University of Iceland

- Steenekamp, B et. al. (2014) The middle class in contemporary South Africa: comparing rival approaches. Stellenbosch Economic Working papers: 11/14, Stellenbosch University.

- Kuper, S (2013) ‘The great middle class identity crisis’, 8 November 2013, The Financial Times.

- Broughton, N; Ezeyi, O; Hupkau, C (2014) Riders on the storm. Britain’s middle income household since 2007. Social Market Foundation, p.14f

- Waldron, T (2012) ‘One in four American workers will be in low-wage jobs for the next decade’, 2 August 2012, ThinkProgress.

- A precariat is a social class suffering from precarity, or without predictability or security.

- Seymour, R (2012) We are all precarious. On the concept of the ‘precariat’ and its misuses. New Left Project

- Ferreira, FHG; Messina, J; Rigolini, J et al. (2013) Economic Mobility and the Rise of the Latin American Middle Class. World Bank Publication No 11858, The World Bank

- Regis Bigot, Patricia Croutte, Joerg Mueller, Guillaume Osier (2011, December), Les Classes Moyennes en Europe, Report No 282, CREDOC

- Willsher, K (2013) ‘Stéphane Hessel, Writer and Inspiration behind Occupy Movement, Dies at 95’, 27 February 2013, The Guardian

- Paul Taylor (2012), writes in The Lost Decade of the Middle Class. Fewer, Poorer, Gloomier, a publication of the Pew Research Center, Social and Demographic Trends that, in the United States, the squeezing of the middle has left its mark on self-perception as well. Self-categorization of being middle class decreased by 20% since 2008, whereas the number of people who perceive themselves as lower or lower-middle class increased by 15% by 2014. This self-ascribed status, however, corresponds to the actual size of the middle income group determined by income, in contrast to the French example. More strikingly, a Pew Research Study also found that ‘many of the demographic groups that have fared worst during the recession – including young adults […], blacks and Hispanics – have the most upbeat assessment of their own economic mobility, their children’s economic prospects and the nation’s economic future’.

- Taylor, P (2012) The lost decade of the middle class. Fewer, poorer, gloomier. Pew Research Center, Social and Demographic Trends

- Mudde, C (2014) ‘The far right in the 2014 European elections: Of earthquakes, cartels and designer fascists’, 30 May 2014, The Washington Post

- Bigot, R; Croutte, P et al. (2012), The Middle Classes in Europe: Evidence from the LIS Data. LIS Working Paper Series, No. 580

- Heath, A; Savage, M; Senior, N (2013) Social class. The role of class in shaping social attitudes. British Social Attitudes 30, National Center for Social Research

- The Economist (2014) The Eurosceptic Union. Europe’s Elections, 31 May 2014, The Economist